TE Connectivity to Acquire Deutsch

November 29, 2011

TE Connectivity to Acquire Deutsch

November 29, 2011

Page 2

November 29, 2011

Forward-Looking Statements

This presentation contains certain “forward-looking statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are

subject to risks, uncertainty and changes in circumstances, which may cause actual results, performance, financial

condition or achievements to differ materially from anticipated results, performance, financial condition or achievements.

All statements contained herein that are not clearly historical in nature are forward-looking and the words “anticipate,”

“believe,” “expect,” “estimate,” “plan,” and similar expressions are generally intended to identify forward-looking

statements. We have no intention and are under no obligation to update or alter (and expressly disclaim any such

intention or obligation to do so) our forward-looking statements whether as a result of new information, future events or

otherwise, except to the extent required by law. In addition to our future financial condition and operating results, the

forward-looking statements in this presentation include statements addressing our ability to execute an acquisition

agreement to acquire Deutsch (the “Deutsch Acquisition”), our ability to fund and consummate the Deutsch Acquisition,

including the entry into financing arrangements and the receipt of regulatory approvals; and our ability to realize

projected financial impacts of and to integrate the Deutsch Acquisition. Examples of factors that could cause actual

results to differ materially from those described in the forward-looking statements include, among others, the risk that the

execution of an acquisition agreement to purchase Deutsch and to close the Deutsch Acquisition may not be

consummated; the risk that a regulatory approval that may be required for the Deutsch Acquisition is not obtained or is

obtained subject to conditions that are not anticipated; the risk that revenue opportunities, cost savings and other

anticipated synergies from the Deutsch Acquisition may not be fully realized or may take longer to realize than expected;

the risk that Deutsch’s operations will not be successfully integrated into ours; business, economic, competitive and

regulatory risks, such as conditions affecting demand for products, particularly the automotive industry and the

telecommunications, computer and consumer electronics industries; competition and pricing pressure; fluctuations in

foreign currency exchange rates and commodity prices; natural disasters and political, economic and military instability in

countries in which we operate; developments in the credit markets; future goodwill impairment; compliance with current

and future environmental and other laws and regulations; and the possible effects on us of changes in tax laws, tax

treaties and other legislation. More detailed information about these and other factors is set forth in our Annual Report on

Form 10-K for the fiscal year ended Sept. 30, 2011 as well as in our Current Reports on Form 8-K and other reports filed

by us with the U.S. Securities and Exchange Commission.

Page 3

November 29, 2011

Acquisition Overview

Best-in-class connectivity for

harsh environments

Strong customer relationships

73 year proven history of high-

quality products

~80% of products are custom

Estimated 2011 revenues of

$670 million, EBITDA of ~26%

• TE has entered into exclusive negotiations and made a

binding offer valued at €1.55 billion to acquire Deutsch

from the Wendel Group

• Expands our capability to offer a complete range of

connectivity solutions across all major industries,

applications and regions

• Deutsch brings a range of highly-engineered, custom

connectivity solutions for harsh environment applications

¾

Adds key circular connector product line

• Provides higher-margin complementary products for

applications in long-cycle industries with strong secular

trends

¾

Commercial aerospace growth

¾

Increase in emissions standards globally

• Significant value expected for shareholders with revenue

and tax synergies as well as operational efficiencies

Page 4

November 29, 2011

Deutsch Overview

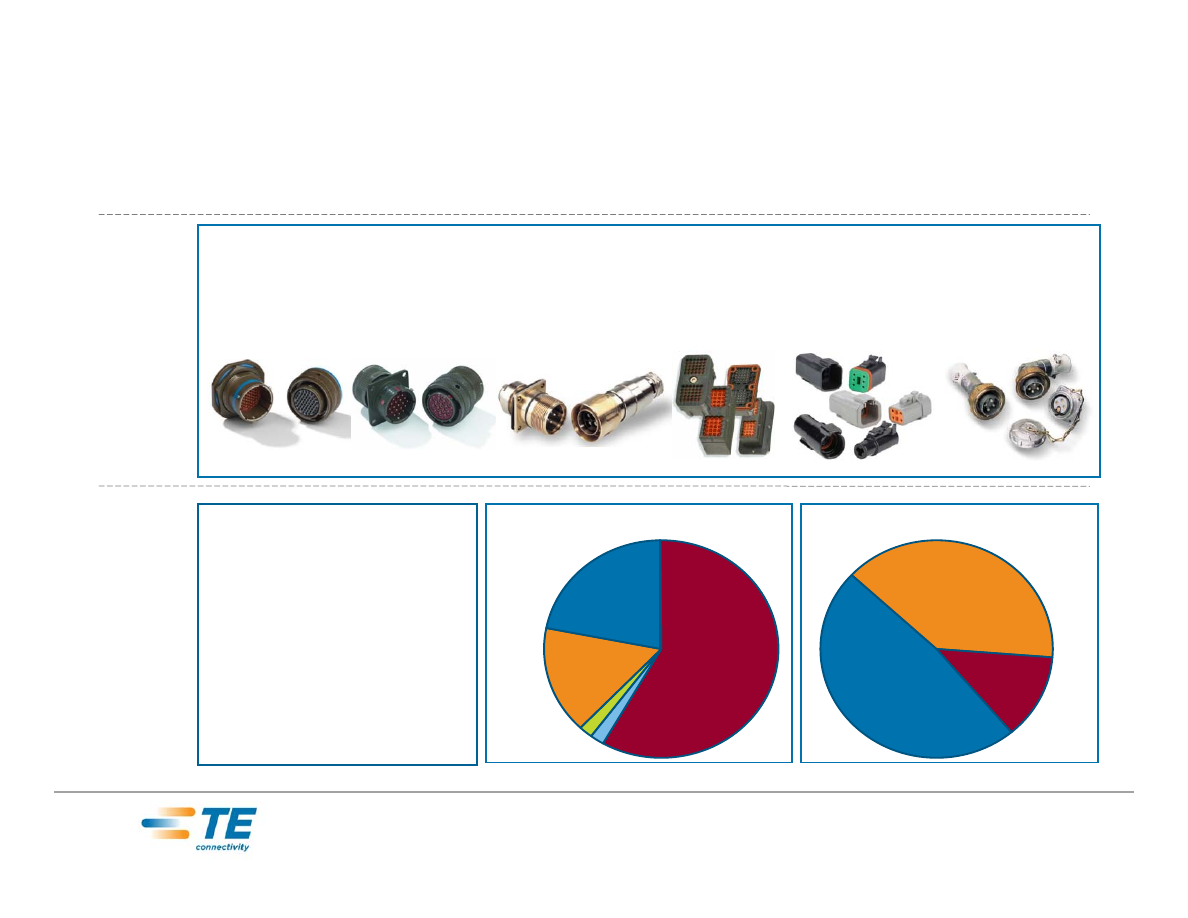

Key

Metrics

Key

Products

Deutsch is a leading supplier of interconnect products for harsh environments.

Segments include industrial transportation, commercial aerospace, military, rail and offshore oil and gas.

Deutsch was founded in 1938 and is owned by the Wendel Group.

Overview

Circular connectors (aluminum, nickel plated, screw locking, environmentally sealed, hermetically sealed,

water tight, fiber optic, microwave)

Rectangular connectors (thermoplastic, hermetically sealed, environmentally sealed, composite, latching)

Splitter boxes (controller area network, environmentally sealed, bayonet locking)

•

2011 Estimated Financials:

– Revenue ~$670 million

– EBITDA ~26% of sales

•

Employees: ~3,600

•

Manufacturing Facilities:

– U.S.

– France

– China

– Mexico

– India

– U.K.

Asia

7%

North

America

48%

EMEA

45%

% of Sales By Region

Offshore 2%

Industrial

Transportation

58%

Aerospace

22%

% of Sales By Application

Military

16%

Rail 2%

Page 5

November 29, 2011

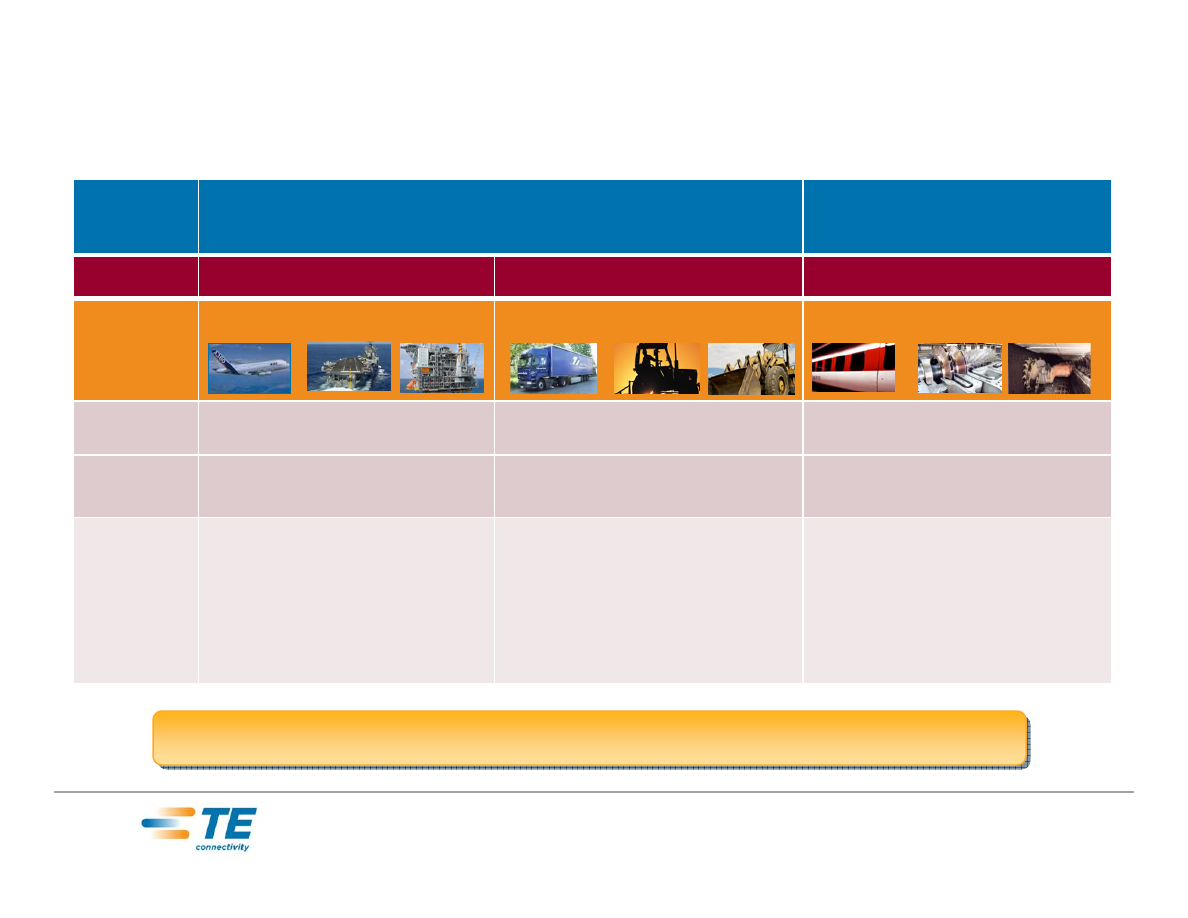

Fills Key Product Gaps

Expands Our Portfolio for Harsh Environments

Expands Our Portfolio for Harsh Environments

TE

Segment

Transportation Solutions

Communications &

Industrial Solutions

Industry

Aerospace & Defense

Industrial Transportation

Industrial Equipment

Application

Commercial

Aerospace Military Offshore

Truck Agriculture Construction

Mining, Water

Rail MEFA Nuclear

5-year

CAGR

~6%

~6%

~5%

Deutsch‘s

Revenue

~$250M

~$400M

~$20M

Strategic

Benefit of

Acquisition

• Adds circular connector

products

• Leading positions in new

commercial air platforms

• An entry into offshore oil & gas

connectivity

• Complementary products create

a leader in commercial vehicles

• A full product portfolio to address

faster-growing emerging markets

• Expands existing portfolio with

addition of circular connector

products

• Optimize TE OEM and channel

partners to increase penetration

of Deutsch products

Page 6

November 29, 2011

Industrial Transportation Applications

Engine Control Unit

1

Engine / Sensor connectors

2

1

2

3

4

Agriculture Vehicles

1

3

4

2

Construction Equipment

1

2

3

4

Heavy Trucks

Chassis / in-line connectors

3

Bulkhead connectors

4

Page 7

November 29, 2011

Engine

Aerospace and Defense Applications

1

Airframe

2

Avionics

3

Landing gear

4

1

2

4

Commercial Aircraft

Military Aircraft

1

2

3

Helicopters

Weapon systems

5

1

3

5

2

3

Page 8

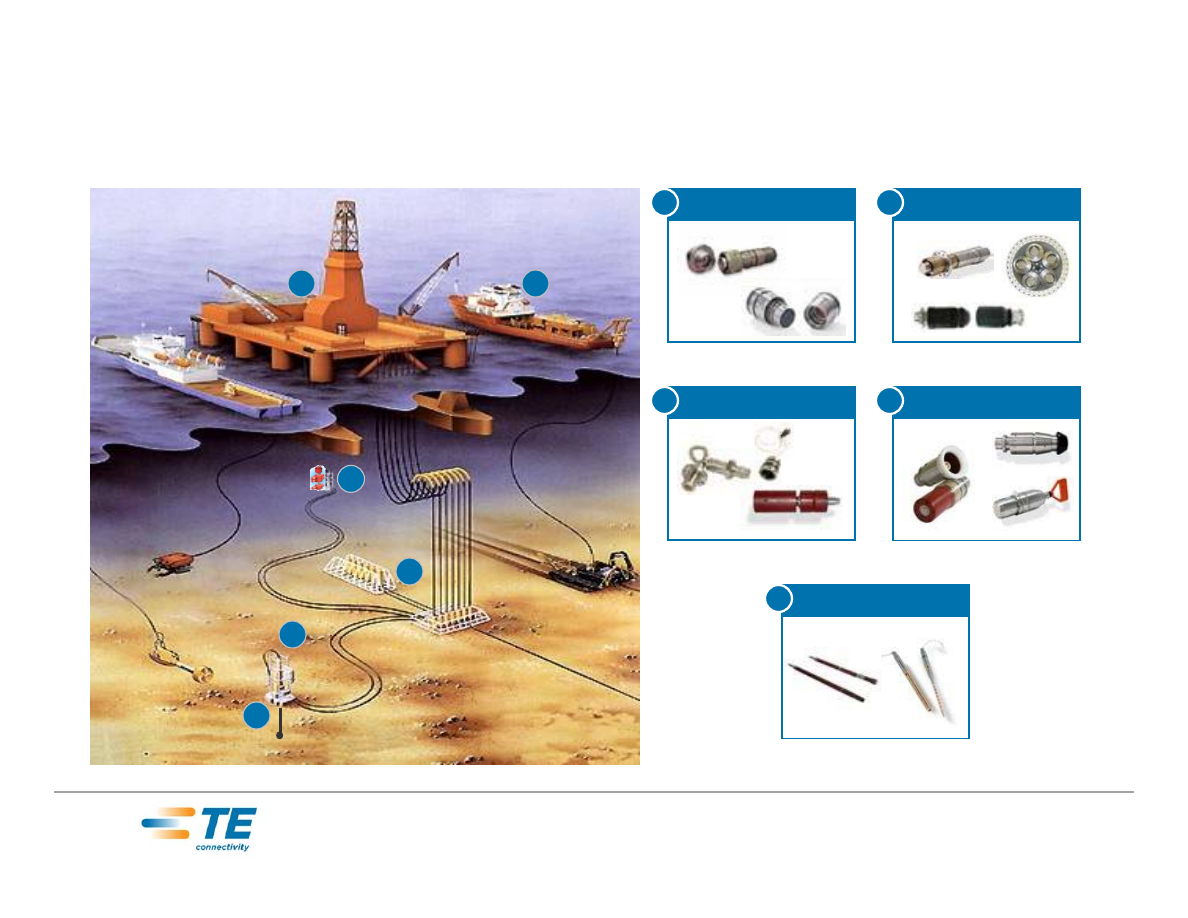

November 29, 2011

Marine and Offshore Applications

Topside

2

Subsea equipment

4

Down-hole

5

Tree

3

1

3

5

2

4

4

Seismic

1

Page 9

November 29, 2011

Transaction Summary

Enterprise

Value

• €1.55 billion

¾

~$2.06 billion at current exchange rates

¾

“Effective” net purchase price of ~$1.8 billion (~$250 million of NPV

related to tax attributes and synergies)

Financing

• Expect ~50% cash and ~50% new debt

• Expect to pay off existing TE debt of ~$700 million at maturity in FY 2013

Tax

• Expect ~10% cash tax rate

• Drives ~$250 million of value on an NPV basis

Return

• Expect ROIC of ~11% in FY 2015

Accretion

• Expect ~$0.20 accretion in FY 2013, excluding one-time costs

• Expect one-time cash costs of ~$75 million

Timing

• Expected to close by fiscal Q3 2012, contingent upon completion of

customary regulatory clearances

TE’s binding offer is subject to customary regulatory approvals including consultation by Deutsch with the Workers' Council, which

is required under French law

Page 10

November 29, 2011

Target

Today

Organic Sales CAGR

Organic Sales CAGR

Today

Synergies

•

Leverage of combined global supply chain

– TEOA / Lean

– Purchasing

•

Optimize go-to-market and G&A

Operating

Efficiencies

•

Expand Deutsch product sales through

TE’s customer base

•

Expand TE’s product sales through

Deutsch’s customer base

•

Complementary technologies provide

better solutions for our customers

•

Expand penetration in emerging markets

Organic Sales CAGR

~6%

8-10%+

Target

~26%

>30%

Today

EBITDA

Revenue

Expect ~$0.20 of Accretion in FY2013

Expect ~$0.20 of Accretion in FY2013

Page 11

November 29, 2011

Summary

• The proposed acquisition of Deutsch and its products for harsh

environment applications is complementary to TE’s existing

portfolio and expands our capability to offer a complete range

of connectivity solutions

• TE’s customer base, geographic presence, and sales and

engineering strength is expected to drive growth for Deutsch

products at 8-10%+ annually

• Significant value expected for shareholders with increased

growth, operating efficiencies and tax synergies

¾

Synergies to drive EBITDA >30%

¾

FY2013 Accretion to adjusted EPS of ~ $0.20 per share

¾

ROIC above cost of capital in year 3

Page 12

November 29, 2011

Non-GAAP Measures

The forecasted earnings per share amount, as adjusted, that is set forth in this presentation is a non-GAAP (U.S.

generally accepted accounting principles) measure and should not be considered a replacement for GAAP results. The

company uses diluted earnings per share from continuing operations attributable to TE Connectivity Ltd. before special

items, including charges or income related to legal settlements and reserves, restructuring and other charges, acquisition

related charges, tax sharing income related to certain proposed adjustments to prior period tax returns and other tax

items, certain significant special tax items and, if applicable, related tax effects ("Adjusted Earnings Per Share" or

"Adjusted EPS"). We use Adjusted EPS because we believe that it is appropriate for investors to consider results

excluding these items in addition to results in accordance with GAAP. We believe such a measure provides a picture of

our results that is more comparable among periods since it excludes the impact of special items, which may recur, but

tend to be irregular as to timing, thereby making comparisons between periods more difficult. It also is a significant

component in our incentive compensation plans. The limitation of this measure is that it excludes the financial impact of

items that would otherwise either increase or decrease our reported results. This limitation is best addressed by using

Adjusted Earnings Per Share in combination with diluted earnings per share from continuing operations attributable to TE

Connectivity Ltd. (the most comparable GAAP measure) in order to better understand the amounts, character and

impact of any increase or decrease on reported results.

The forecasted EBITDA margin amount for Deutsch that is set forth in this presentation is a non-GAAP measure and

should not be considered a replacement for GAAP results. EBITDA represents net income before interest expense,

interest income, income taxes, depreciation and amortization. EBITDA is not intended to represent Deutsch’s results of

operations in accordance with GAAP and should not be considered a substitute for net income or any other operating

measure prepared in accordance with GAAP.

Because we do not predict the amount and timing of special items that might occur in the future, and our forecasts are

developed at a level of detail different than that used to prepare GAAP-based financial measures, we do not provide

reconciliations to GAAP of our forward-looking financial measures.